Earning Your Solar Tax Credit: 4 Simple Steps

Purchase (not lease) and install an approved solar array on your home

Fill out IRS Form 5695 to claim Solar Tax Credit for 30 percent of the cost of the array

Take that 30 percent off the total amount you owe the IRS

Enjoy years of clean, renewable power

Using the earth’s natural resources to fuel our lives feels right and makes sense – for the environment and our wallets. Solar energy systems not only reduce negative environmental impacts, they also create jobs, save homeowners money, and foster national energy independence by moving away from reliance on foreign oil.

Solar has nearly universal appeal and is enticing to many different types, so there is a good reason to install solar whether you’re doing it for the financial aspects, environmental, energy independence, emergency preparedness or a combination of all of them.

Managing Director at Elemental Energy

The federal government offers an incentive to encourage homeowners to invest in solar energy. By promoting solar energy now, the industry will be able to grow and hold its own in the future, which means reduced solar energy costs in the long run. This incentive is a federal investment tax credit (ITC). People who invest in residential solar energy systems get a portion of the system’s cost back when tax season comes around, which can result in significant savings. This guide gives a rundown on the federal ITC, how it works, who qualifies and how to get it and other tax credits.

Investment Tax Credit: In-Depth

Because it is a credit, the ITC provides a dollar-for-dollar return on a solar power system’s cost. This is better than a tax deduction because it reduces the actual taxes owed rather than just reducing one’s taxable income. So if a person’s solar energy system costs $12,000, he or she will get a $3,600 reduction in taxes owed to the government. In some cases, people who install solar energy systems don’t have to pay any federal taxes because the credit covers their liability entirely.

If the home you are putting a solar system on is solely a rental property, you cannot claim the federal tax credit. But if you live in the home part of the year, you can make a partial claim toward the ITC for the time you live there. You can claim the percentage of the credit that equals the percentage of time during the year you are in the home.

If you can manage to put in the upfront cost by any means, whether through cash, loans or other resources, then a huge part of that cost will be coming back to you in incentives quickly. It’s almost like moving the money into a savings account that you can’t touch for a few years, but then you get it right back. You’ll get 30 percent within a year, plus any incentives available in your state. All that is aside from the energy savings, which you get as soon as the system is installed.

ITC Explained

The tax credit is for homeowners and can be applied if the solar energy system was placed in service after Jan. 1, 2006, and is being used for the first time.

The homeowner must own the solar energy system through outright purchase or through a loan. If the system is leased, the leasing company owns the system and receives the ITC.

The credit is calculated after any rebates and other discounts have been applied to the system’s cost, but installation expenses are included in the system’s net cost.

There is no upper limit to the tax credit in regards to how big or costly the installed solar system can be.

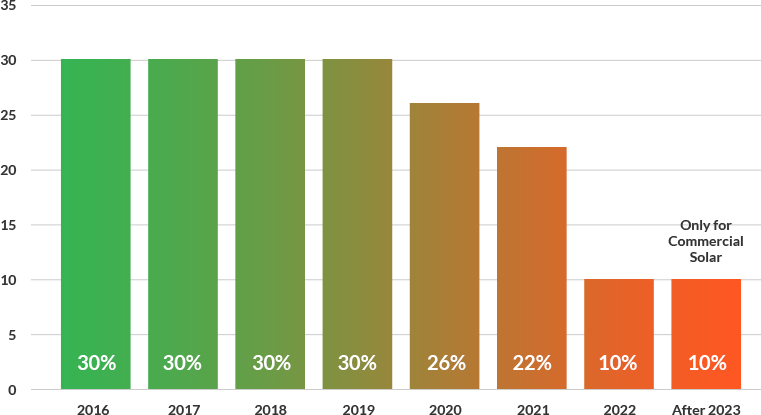

The ITC was implemented in 2006 and was expected to end 10 years later. However, Congress has extended the credit through 2019 with a drop-down until 2022. Little notes that the extension will not only provide a better phase-out of the subsidy, but it will also give the solar industry a huge push toward self-reliance.

The extension was unexpected and better than most of us were hoping for. I expect it to do a better job of gently phasing the incentive out. It’s interesting that after it passed, expected installs decreased for 2016 because everyone was planning on cramming in before the year ended, but the expected increased capacity for years beyond is now looking great and allowing for us and others to hire and really establish long term plans.

Which Tax Scenario Fits You?

Take a look at Jane, Joe and Bob’s situations to see which scenario works best for you.

Owing fewer taxes

Owing fewer taxes After rebates were applied, Jane’s solar energy system cost $15,000. She gets a $4,500 tax credit from the government. Jane owes $7,000 in taxes so she ends up only having to pay $2,500 after her solar credit is applied.

Owing no taxes

Owing no taxes Joe calculates the cost of his solar energy system and figures out he will get an $8,100 credit. Joe knows he usually owes about $10,000 in taxes, so he goes to his employer to adjust his withholdings. Joe’s taxes are now $8,100, and he owes nothing after his solar tax credit is applied.

Owing no tax with leftover credit

Owing no tax with leftover credit Bob doesn’t owe nearly as much taxes as Jane or Joe. He gets a $6,900 tax credit from his solar energy system but only owes $2,000 in taxes. Now Bob has $4,900 of his tax credit left. The credit is not refundable, but it does roll over for him to use over the next five years.

Little suggests using the credit up to its maximum as early as possible since it’s “money on the table waiting to be invested.”

Planning to purchase a solar energy system can be tricky. We can help you understand solar, but we aren’t tax experts, so it’s a good idea to contact an accountant or tax professional to help you figure out the particulars of your solar tax credit situation.

Loan vs. Lease: Effects on Tax Credit

People who don’t want to pay the full price of their solar panel systems upfront but still want to receive the tax credit can get a solar loan. With a solar loan, homeowners are able to claim the solar investment tax credit without the hefty upfront cost of owning a solar power system. Plus, individuals with solar loans can start saving money on their electric bills even while repaying the loan.

A loan is better than a lease because it means ownership. Ownership means that you get all the tax credits and all the electric savings. There are no- and low-money down loan options that can offer the same amount as a lease in terms of monthly payments, but all the benefits go to the homeowner.

How to Calculate & Claim Your Credit

Combine the cost of the system with related installation fees.

Subtract any rebates from your utility. If state and local government rebates received aren’t considered income, subtract those, too.

After calculating the solar energy system’s net cost, fill out form 5695 to determine the amount of your credit.

Put the credit amount in the indicated line on form 1040. If the credit exceeds the taxes owed, the credit can be carried over into the next year.